Russia remained the leading country for rough diamond production by value in 2024, holding its position for a second consecutive year.

According to data released by the Kimberley Process, the Russian Federation produced 37.3 million carats of rough diamonds, valued at $3.34 billion, despite continued international sanctions and a subdued global market.

Production Trends and Market Conditions

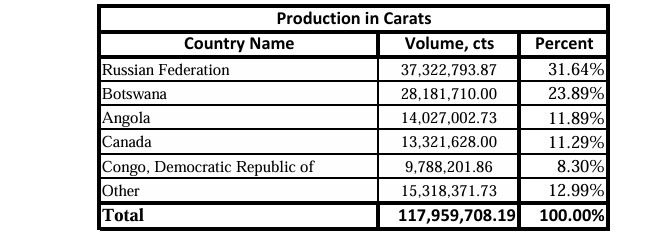

Global rough diamond production increased by 6% in volume to 118 million carats. However, the total value declined by 10% year-on-year to $11.48 billion, reflecting weaker consumer demand and lower average prices across key producing countries.

Russia’s output matched the previous year’s volume but declined in value from $3.61 billion in 2023. The average price per carat fell from $97 to $89. Botswana, the second-largest producer by value, recovered 28.2 million carats worth $3.31 billion, down slightly in average value per carat from $131 to $117. This shift is linked to a transition in the product mix at the Jwaneng mine, which is undergoing expansion.

Angola, Canada and the Democratic Republic of Congo were also significant contributors to global production, collectively accounting for over 30% of volume.

International Trade Patterns

Global trade in rough diamonds remained active. Total exports reached 284.9 million carats, valued at $30 billion. The United Arab Emirates was the largest exporter by volume, shipping 85.7 million carats worth $9.83 billion. The European Union and Russia followed, exporting 40 million and 30.4 million carats respectively.

In value terms, the EU ranked second with $4.32 billion, followed by Botswana at $2.81 billion, Russia at $2.62 billion, and South Africa at $1.58 billion.

Global imports totalled 287.4 million carats with a combined value of $30.8 billion. India remained the largest importer, receiving 114.1 million carats valued at over $11 billion, consistent with its established role in diamond cutting and polishing. The UAE, EU, China and Armenia also featured prominently in import volumes.

Implications for the Jewellery Sector

The mismatch between higher production volumes and lower values suggests continued instability in the diamond market. For jewellers, this may signal variability in supply costs and pricing structures in the months ahead.

India’s position in imports and processing highlights the importance of its manufacturing sector within the global jewellery supply chain. Changes in production levels and trade flows may influence supply conditions and pricing, making it important for jewellers to remain informed about market trends.